A few weeks ago, I posted about Langley City’s 2018 financial results. Langley City’s revenue was higher than budgeted in 2018, and expenditures were lower than budgeted. You can read that post for more details. People asked me if that means their property tax will be lowered in future years as a result. Currently, the answer to that is no. Of course, a tax break would be nice, but investing in infrastructure which supports the long-term health of our community and its residents is critical.

Municipalities in BC are responsible for a significant amount of infrastructure. This infrastructure includes water and sewer lines; roads, bridges, and pathways; and parks and recreation facilities. Some municipalities are even responsible for electrical distribution. According to the Federation of Canadian Municipalities, around 60% of public infrastructure is owned by local governments.

Around 12% of your total taxes are directly controlled by local governments. About 2.5% is used for investing in infrastructure. The remaining funding is used to deliver day-to-day services. Langley City is a typical municipality in this regard.

Langley City’s was built-out between the 1960s and early 1990s. Since that time, any new development in our community has been redevelopment. When the infrastructure was put in to support our community in the 20th century, it was design for a service life of around 50 years. Today, we build infrastructure for a service life of around 100 years. The short of it is that there is a whole lot of infrastructure that is end-of-life in our community.

When infrastructure is at its end-of-life, it doesn’t mean that it just suddenly stops working. It does mean that the cost to maintain that infrastructure rapidly increases. It also means that the likelihood of failures also increase. Some examples of what happens with end-of-life infrastructure include bursting water mains and rough roads. In some municipalities (not Langley City), it could also mean bridge failures.

Langley City council has been providing funding to renew or replace end-of-life infrastructure, but the money budgeted currently does not match the money required to ensure all our infrastructure is in a state of good repair today and into the future.

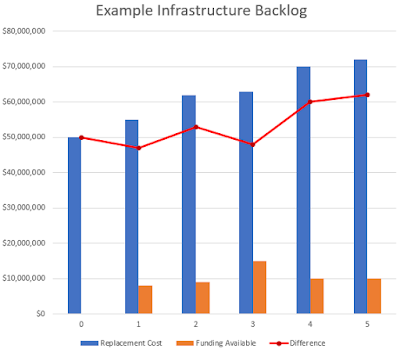

The following chart shows the cost to replace or renew all end-of-life infrastructure in an example municipality, year-over-year in blue. It also shows the funding that is available to replace or renew end-of-life infrastructure in an example municipality year-over-year. The red line shows the different between funding required and funding available, and it continues to climb year-over-year.

|

| An example of infrastructure backlog in a typical municipality. Select chart to enlarge. |

It is expected that all municipalities have a backlog of infrastructure that needs to be replaced. Where things get concerning is when that backlog only continues to climb like the red line in the example.

In Langley City, we have a growing backlog of infrastructure that needs to be replaced or renewed. While the federal and provincial governments do provide grants to help renew infrastructure, this funding is not predictable. This is why there is an infrastructure levy on your property tax bill in Langley City. It is also why any budget surplus is used to replace or renew infrastructure in our community.

No comments:

Post a Comment