I know there are some misconceptions about municipal property tax and how your

assessed property value relates to the property tax you pay. I will use some

examples to show the relationship.

We have a small city which has two properties. One property has an assessed

value of $300,000, and the other has an assessed value of $1,000,000. The

small city has $1,300,000 in total assessed property value.

This small city of two properties has $10,000 in expenses. The city will need

to collect $10,000 in property taxes to pay for these expenses.

To calculate the property tax due, the staff at the small city need to set a

rate. This rate is $10,000 divided by the total assessed value of $1,300,000.

The rate is 0.00769231.

The owner of the first property will pay $300,000 x 0.00769231 =

$2,307.69 in property tax.

The owner of the second property will pay $1,000,000 x 0.00769231 =

$7,692.31 in property tax.

A year later, assessed property values have changed. Both properties have

increased 20% in value.

The first property now has an assessed value of $360,000.00.

The second property now has an assessed value of $1,200,000.

The small city still has $10,000 in expenses, so it will need to divide the

$10,000 in property tax it needs to collect by the new $1,560,000 in total

assessed property value. The rate is 0.00641026.

The owner of the first property will pay $360,000 x 0.00641026 =

$2,307.69 in property tax.

The owner of the second property will pay $1,200,000 x 0.00641026 =

$7,692.31 in property tax.

The property taxes did not change.

The following year, property values have stayed the same, but the cost of

delivering services in the small city has increased. The city now has $12,000

in expense, so they need to raise $12,000 in property tax. The new rate is

$12,000 divided by $1,560,000 in total assessed property value which equals

0.00769231.

The owner of the first property will pay $360,000 x 0.00769231 =

$2,769.23 in property tax.

The owner of the second property will pay $1,200,000 x 0.00769231 =

$9,230.77 in property tax.

The city’s expenses and both properties’ taxes went up 20%.

A year later, the property values change yet again.

The first property owner’s townhouse increases in value 20%. The second

property owner’s single-family home increased in value by 40%.

The first property now has an assessed value of $432,000.00.

The second property now has an assessed value of $1,680,000.

The small city still has $12,000 in expenses, so they still need to raise

$12,000 in property tax. City staff divide $12,000 into the new total assessed

property value of $2,112,000. The rate is 0.00568182.

The owner of the first property will pay $432,000 x 0.00568182 =

$2,454.55 in property tax.

The owner of the second property will pay $1,680,000 x 0.00568182 =

$9,545.46 in property tax.

Even though the city’s expenses did not change, the first property owner

sees an 11.4% decrease in property tax while the second property owner sees

a property tax increase of 3.4%.

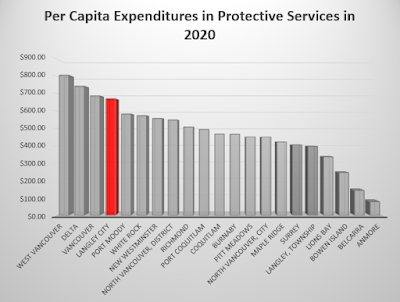

As I posted yesterday, Langely City needs to increase its property taxes by

4.35% to cover new expenses. In Langley City, single-family homes increased in

value at a faster rate than townhouses or apartments last year.

So let’s look at this final example.

The small city’s expenses need to increase by 4.35% from $12,000 to $12,522.

The first property owner’s townhouse increased in value by 15%. The second

property owner’s single-family home increased in value by 30%.

The first property now has an assessed value of $496,000.

The second property now has an assessed value of $2,184,000

The small city has a total assessed property value of $2,680,000. $12,522 in

expense divided by $2,680,000 in total property values means the rate is now

0.00467239.

The owner of the first property will pay $496,000 x 0.00467239 =

$2,317.50 in property tax.

The owner of the second property will pay $2,184,000 x 0.00467239 =

$10,204.49 in property tax.

The small city’s expense increase 4.35%, the first property owners taxes

decrease by 5.6% while the second property owners taxes increase by 6.9%.

These examples show how a city’s budget increase, changes in assessed property

values, and property taxes are related.

You can see the actual changes in your property taxes over the years by

visiting

Langley City’s Property Information search portal.