In BC, municipalities are part of two organizations that help represent our combined interests to the province government. They are part of local area associations and the Union of BC Municipalities.

While these organizations do many other things, one of the ways that they help advocate on behalf of local governments to the provincial government is through the resolutions process.

I will explain how this process works and share two resolutions Langley City Council submitted at our last meeting.

Local governments, like Langley City, will pass resolutions at Council meetings that they would like to see forwarded to their local area association. In Langley City's case, this is the Lower Mainland Local Government Association.

Representatives from local governments debate these resolutions at their area association's annual convention. For resolutions that pass, they get forwarded to the Union of BC Municipalities. At the Union of BC Municipalities annual conference, local government representatives from throughout the province debate these resolutions. For the ones that pass, the Union of BC Municipalities forwards them to the province as these resolutions represent what local governments want the province to take action on.

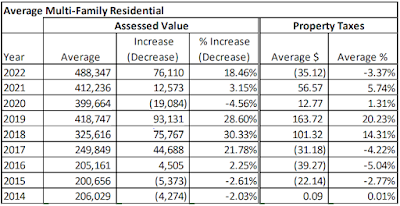

The first resolution that Langley City Council forwarded to our local area association was around residential property taxes. Because there is only one residential tax rate per BC law, and because detached and attached housing change values at different rates, it leads to inconsistent property tax changes. The following tables show the change in tax rates over the last several years by housing type in Langley City.

|

| Change in average attached housing valuation and property taxation between 2014 and 2022 in Langley City. Select the table to enlarge. |

|

| Change in average detached housing valuation and property taxation between 2014 and 2022 in Langley City. Select the table to enlarge. |

As a note, attached housing includes apartments, townhouses, and rowhouses.

The motion is:

WHEREAS the Province of British Columbia specifies that there is one assessment class for all types of residential properties even though the assessed value of attached and detached residential properties change values at different rates and other jurisdictions, such as Ontario, allow different tax rates for attached and detached residential properties;

WHEREAS in Langley City, a 4.94% property tax increase in 2018 resulted in a 0.4% decrease for detached residential properties and a 14.31% increase for attached residential property, and in 2022, a 4.35% property tax increase resulted in a 12.49% increase for detached residential properties and 3.37% decrease for attached residential properties;

THEREFORE BE IT RESOLVED that the Province of British Columbia amend the BC Assessment Act and the Community Charter to allow the residential class to be split into two distinct residential classes so that a different rate may be applied to each type to account for the difference in the rate at which attached and detached residential properties change their value and to allow local government to more accurately charge for the cost of providing services to attached and detached residential properties.

Langley City Council approved the second resolution around infrastructure funding. Like all municipalities in BC, we are responsible for most public infrastructure on the ground, such as transportation, sewer, and water.

In Langley City's 10 square kilometres, the City owns $600 million (replacement value) in transportation, sewer, and water infrastructure. In the next decade, we need to invest $242 million to keep this infrastructure in a state of good repair. Like all municipalities in BC, we need more financial resources to do this. Today, we all have growing infrastructure debts. We have this problem because local governments collect less than 5% of all taxation, with the rest going to the feds and the province. We need a new deal from the feds and the province.

The motion is:

WHEREAS Canada’s infrastructure deficit is estimated to be as high as $570B with almost 60% of the deficit within municipal jurisdictions.

WHEREAS the costs to replace and repair municipal infrastructure for critical services such as roads, arenas, bridges, drinking water, and wastewater systems are estimated to be $141 billion, which is well beyond the financial capacity of municipalities across the country due to limited revenue generation options, and all while costs for infrastructure renewal continue to escalate at an exponential rate.

THEREFORE, BE IT RESOLVED that the Government of Canada create a sustainable and reliable municipal asset management fund, like the permanent Building Canada’s Public Transit Future Fund, to increase investments in infrastructure renewal, which is essential to enhance public safety, reduce health risks, ensure economic sustainability, and lessen the financial burden on future generations to pay for the infrastructure deficit.

I look forward to debating these motions at this year's conferences.

No comments:

Post a Comment